lakewood co sales tax return form

Joint Allocation Form. DR 0235 - Request for Vending Machine Decals.

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller

The breakdown of the 100 sales tax rate is as follows.

. Page 1 of 3 Colorado Department of Revenue Taxpayer Service Division 0813 Sales 90 Sales and Use Tax Refund Requirements Sales and use tax refund claims are categorized as either being a purchasers claim also known as a buyers claim for refund or a sellers claim for refund. Revenue Online closures are effective the next business day. Lakewood Municipal Code 301020 Definitions Sale or Sale and Purchase 301120 Property and services taxed sales tax 301130 Collection of sales tax 301210 Property and services taxed use tax 301220 Collection of use tax 301260 Recovery of taxes penalty and interest.

Individual Income Tax Registration. ATTACH all appropriate W-2s 1099s and other Schedules. Sales tax returns may be filed annually.

Free viewers are required for some of the attached documents. Retailers are responsible to collect this tax on behalf of the City and to remit the tax to the City on SalesUse Tax returns according to the filing frequency established by the City. Complete Edit or Print Tax Forms Instantly.

The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140. Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Valid return forms may be printed from your online account or you.

Some goods and services are exempted from tax in City Code Section 22-58. DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. Your salesuse tax filing frequency has been initially set as Monthly.

Ad Download Or Email CO DR 0100 More Fillable Forms Register and Subscribe Now. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. Returns can be accessed online at Lakewood.

REPORT SALES AND CALCULATE SALES TAX DUE 303 987-7630 MULTIPY LINE 2 BY 10 MULTIPY LINE 2 BY 10 PER MONTH. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis. Under 300 per month.

ACCOUNT NUMBER PHONE NUMBER 00 20-Dec-9999 4268195847 4268195847 Denver Sales Tax Return Monthly City and County of Denver. Sales aggregate to line 1 front of return periods net taxable sales aggregate to line 4 front of return a list of purchases if additional space needed-attach schedule in same format b total purchase price of property subject to city use tax enter totals here and on front of return enter total line b on line 11 on front of return. File Sales Tax Online.

SIGN the printed form. Returns are due on the 20th of month following the end of the period. Filing frequency is determined by the amount of sales tax collected monthly.

Department of Finance Treasury Division PO. DR 0098 100719 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 ColoradogovTax DONOTSEND Form Instructions In preparing a special event sales tax return a seller or. And MAIL the return to City of Lakewood Division of Tax.

The City of Lakewood receives 1 of the 100 sales tax rate. Declaration of Estimated Tax. All sales in the City are subject to the City sales tax according to City Code Section 22-56 and are listed specifically in Section 22-57.

License My Business Determine if your business needs to be licensed with the City and apply online. CITY OF LAKEWOOD COLORADO MISCELLANEOUS SALES TAX REPORTING FORM. Part 11-Code of Laws Chapter 22-Taxation Article 1-Sales and Use.

Tuscaloosa County Sales Tax Return PO. NO DUPLICATE OR REPLICATED FORMS ARE ACCEPTED. P ower of Attorney.

You can close your sales tax account using Revenue Online or by filing the Account Change or Closure Form. Since use tax applies to all businesses and organizations please make sure to understand the use tax explained in the. Box 20738 Tuscaloosa AL 35402-0738 205 722-0540 Fax 205 722-0587 Make checks payable to the Tuscaloosa County Special Tax Board Returns can be filed online at wwwmyalabamataxesalabamagov.

670 Sales Tax Chart. The City of Lakewood does not mail return forms. Initial Use Tax Return.

If you choose to fill-out the form online you must PRINT the form. This form is to be used by new businesses or organizations located in the City of Northglenn to report initial use tax. Please note that a salesuse tax return is due even if no tax is due.

When using a paper form send the completed form to the address on the form. Theres more about exemptions on the page Exemptions from Tax. Download the City of Lakewoods Interactive 2020 L.

There are a few ways to e-file sales tax returns. 15 or less per month. Sales tax returns may be filed quarterly.

Annual returns are due January 20. Sales Tax License Renewal Form. If you have more than one business location you must file a separate return in Revenue Online for each location.

DR 0154 - Sales Tax Return for Occasional Sales. Sales Tax Use Tax. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

TAX AMOUNT DUE PENALTY IF PAID AFTER DUE DATE INTEREST IF PAID AFTER THE DUE DATE 5. Please note that the paper DR 1102 takes longer to process. Standard Municipal Home Rule Affidavit of Exempt Sale.

11701 Community Center Drive Northglenn CO 80233-8061 P. The purchasers claim for refund is submitted on a Claim for Refund of Tax Paid to. The Lakewood Municipal Code LMC imposes a sales tax upon the purchase price paid for tangible personal property and certain taxable services purchased at retail in the City.

Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month.

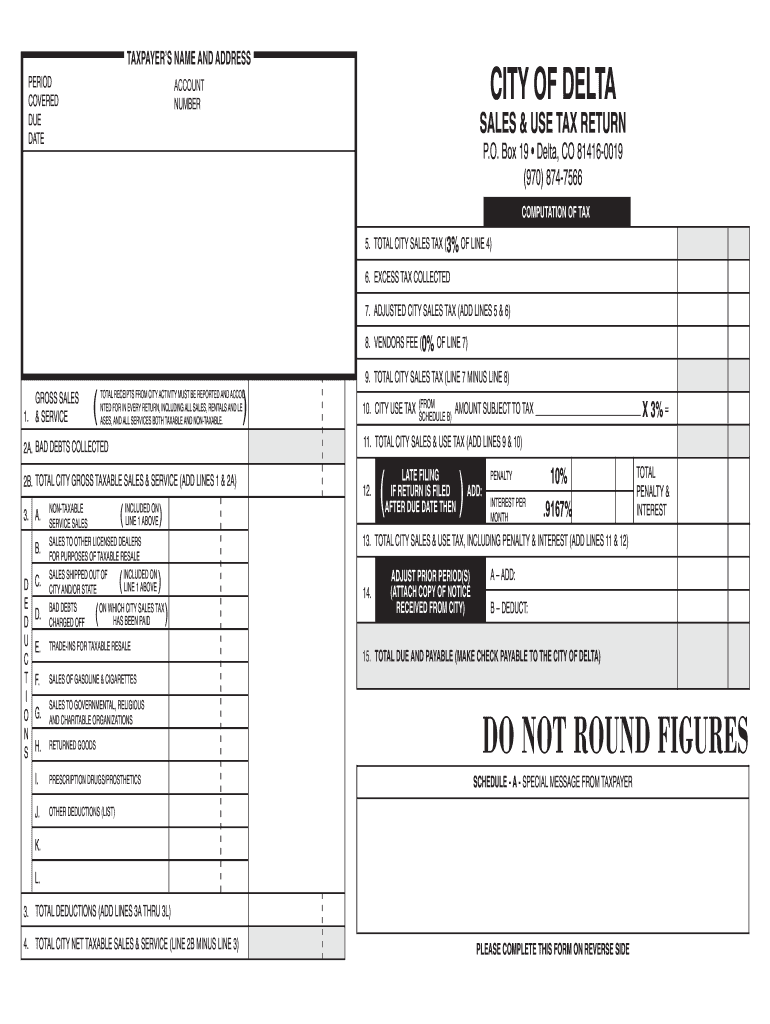

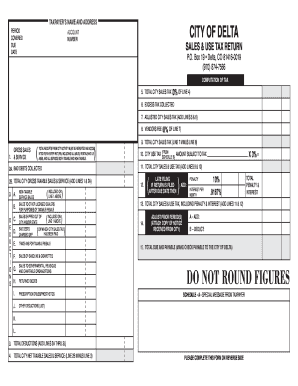

Delta City Sales Tax Fill Online Printable Fillable Blank Pdffiller

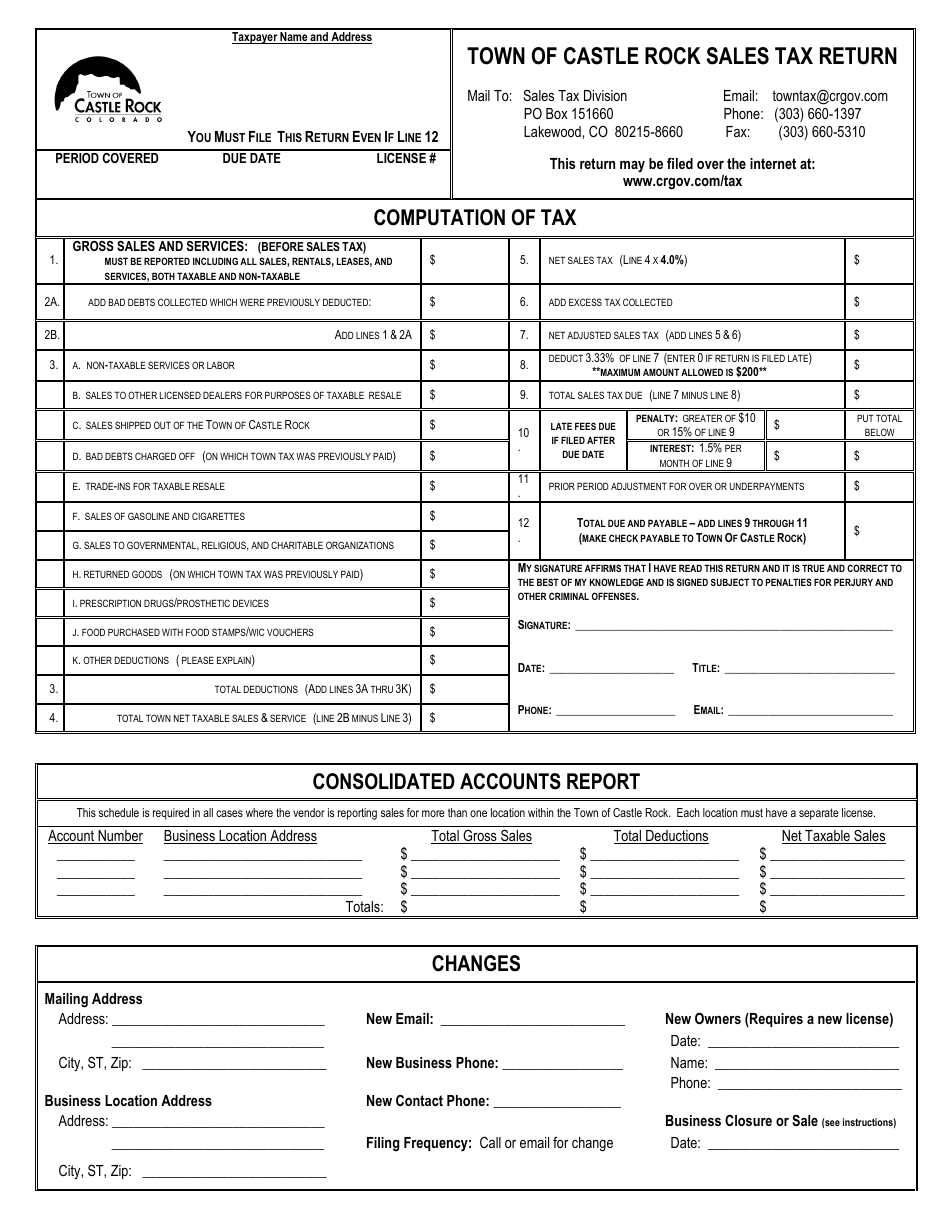

Town Of Castle Rock Colorado Sales Tax Return Form Download Printable Pdf Templateroller

Colorado Springs Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

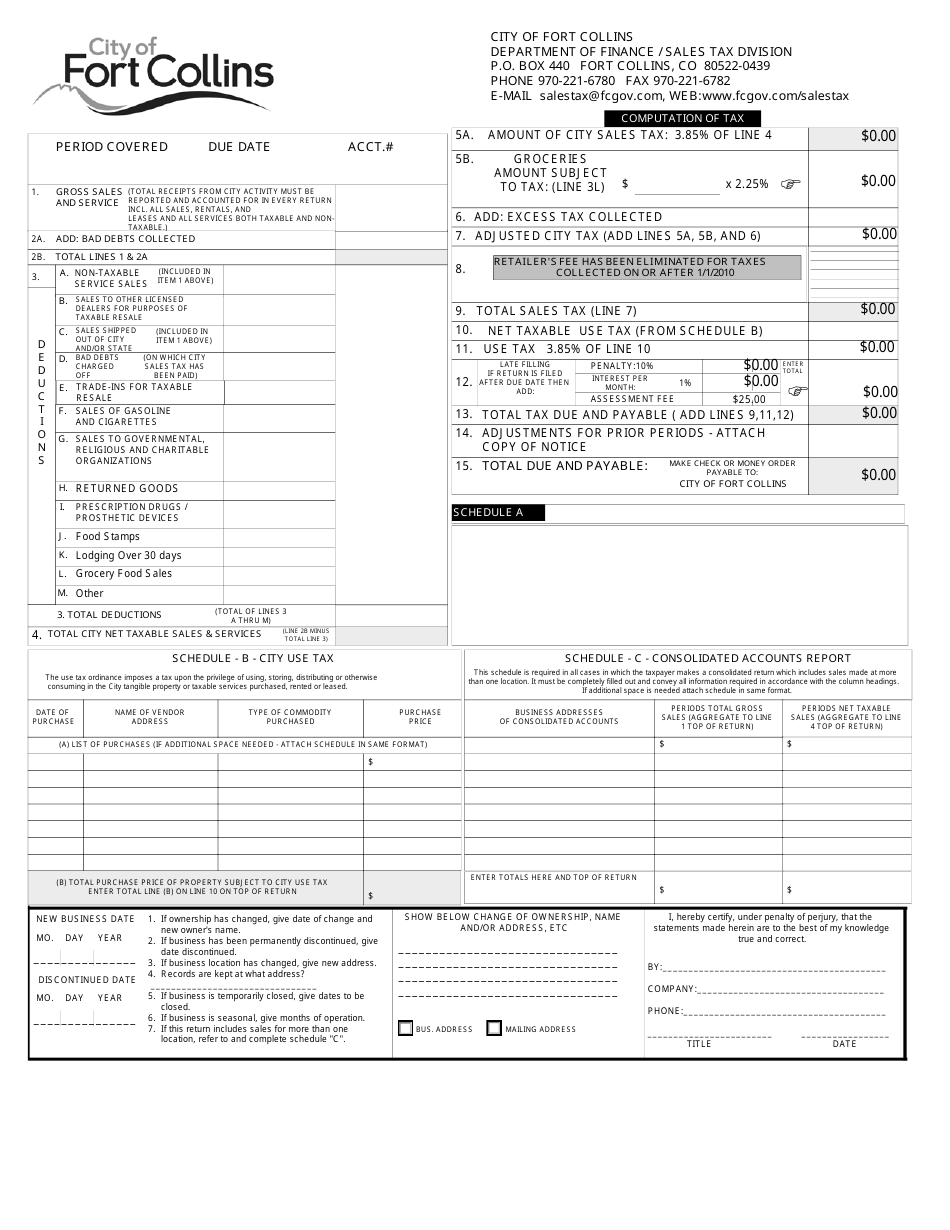

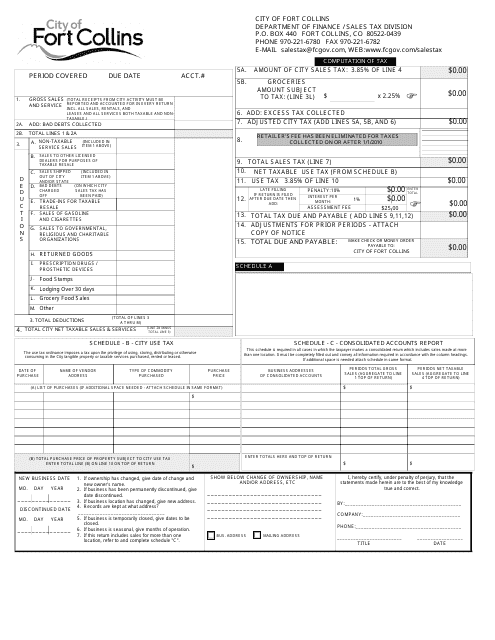

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

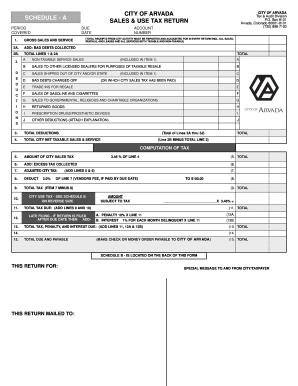

City Of Arvada Sales Tax Fill Out And Sign Printable Pdf Template Signnow

Business Licensing Tax City Of Lakewood

Bw98 Tax Book Quark File Ohio Department Of Taxation

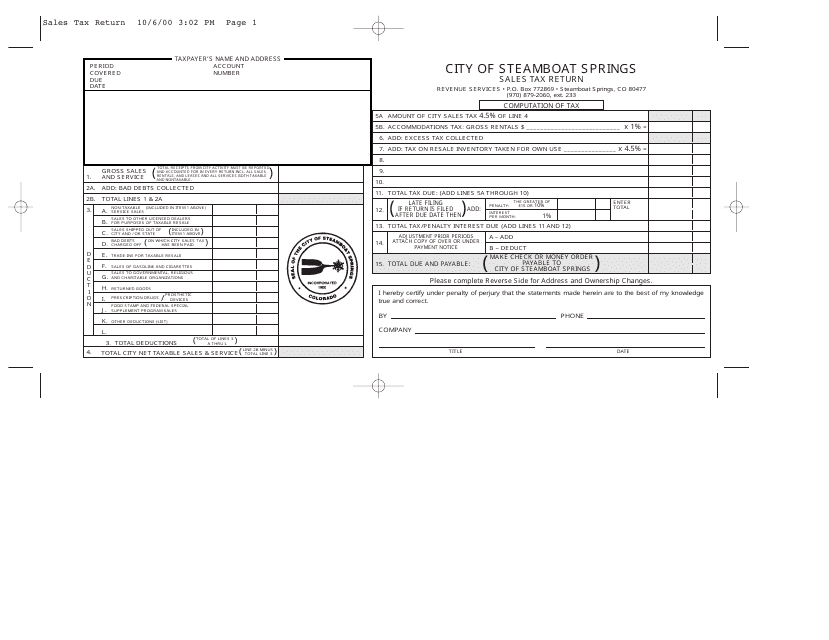

City Of Steamboat Springs Colorado Sales Tax Return Form Download Printable Pdf Templateroller

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

We Make You A Fake Tax Return Document For 2017 Or Earlier Year Great Proof Of Annual Income For Application Purp Tax Return Income Tax Return Irs Tax Forms

2006 City Of Lakewood Sales And Use Tax Return Form Download Fillable Pdf Templateroller

Delta City Sales Tax Fill Online Printable Fillable Blank Pdffiller

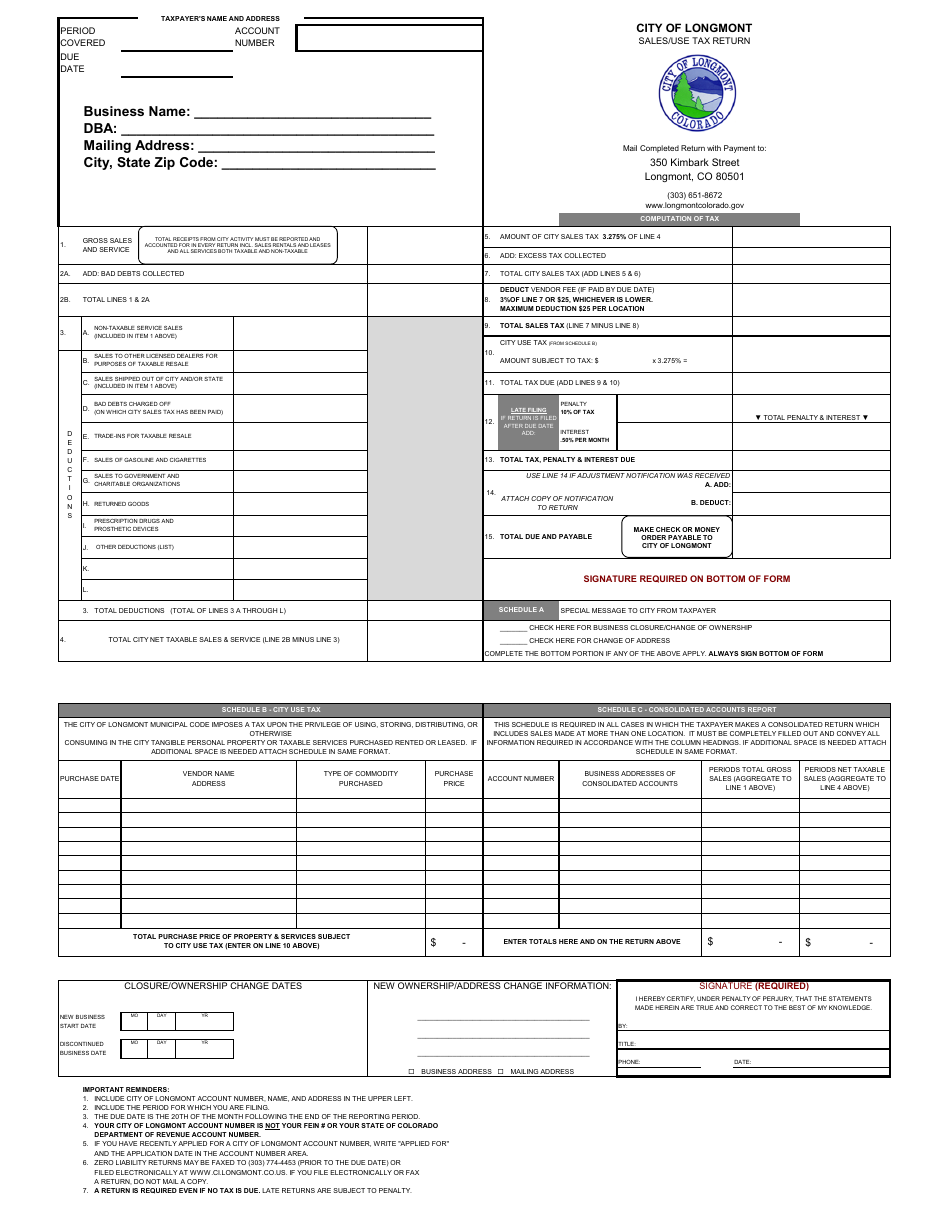

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Fillable Online City Of Lakewood Sales Use Tax Return Fax Email Print Pdffiller

Delta City Sales Tax Fill Online Printable Fillable Blank Pdffiller

Income Tax Form Saral Income Tax Saral Form Pdf Barsutorrent Income Tax Form Saral Income Tax Tax Forms Income

City Of Delta Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller